Strength for today. Bright hope for tomorrow.

One way God demonstrates his faithfulness is through the generosity of his people through gifts in wills.

Thank you for considering blessing us with a gift in your will. CMS is able to do the work we do today thanks to the faithful generosity of previous generations. In the ongoing story of God’s mission, you can help write the next chapter.

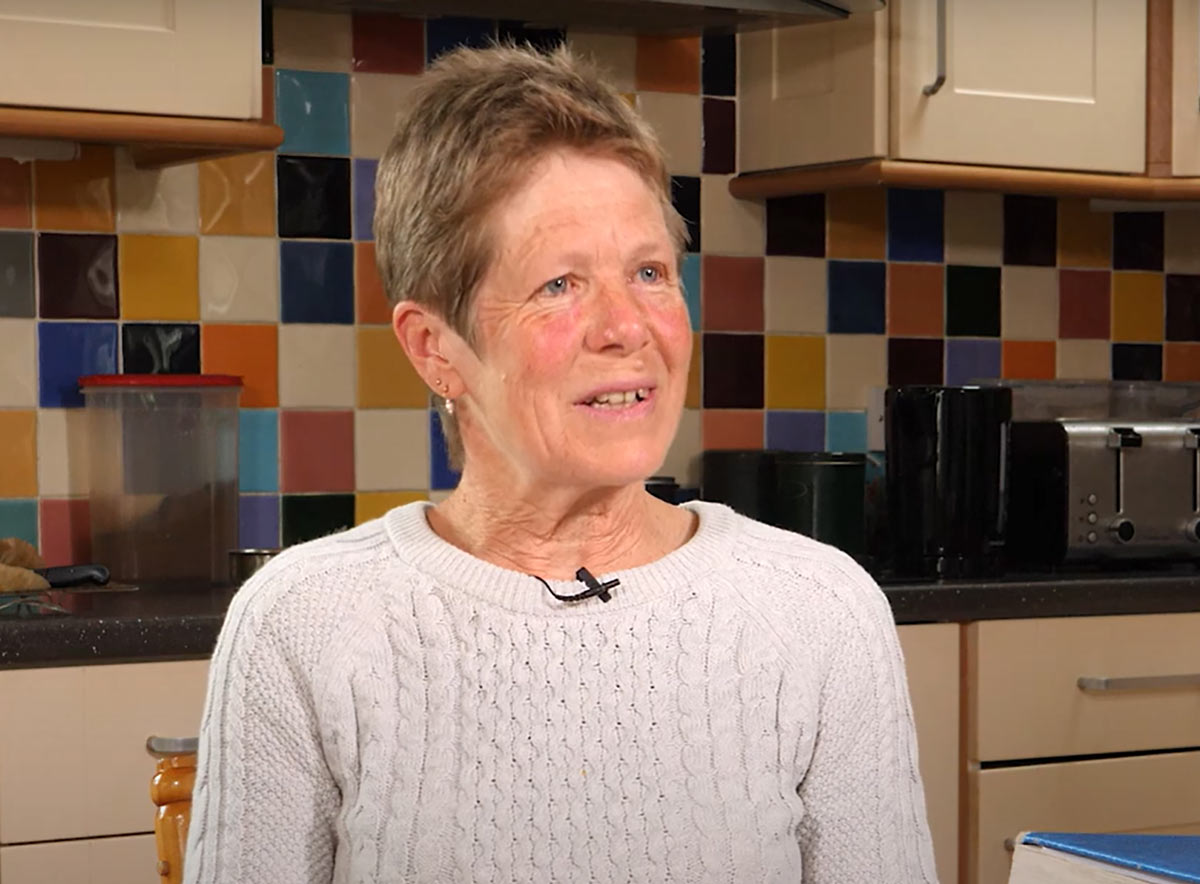

“We were very well supported by other people’s giving while we were overseas and leaving a legacy, is in a way, a continuation of our giving.”

Sue Smye, legacy giver

If you would like more information about how to leave a gift in your will to Church Mission Society, we would be happy to speak with you (details below) or you can request a free booklet using the form below.

Request your free booklet

“We are so thankful to CMS supporters for sharing their legacy, making it possible for us to be in Brazil sharing the word of God. What a beautiful example of love.”

Marcio and Noemi and family, serving in Brazil

If you are thinking of leaving a legacy to CMS in your will and wish to talk to someone about it, please contact Danni Parker at danni.parker@churchmissionsociety.org or call 01865 787521.

If are you an executor, please refer to our information for executors page. Our Senior Legacy Management Lead, Adina Lewis, can be contacted on adina.lewis@churchmissionsociety.org or 01865 787474.

How to leave a gift in your will – FAQs:

We are grateful for any legacy gift, however big or small. We use each gift we receive prayerfully and with integrity as we know how carefully you’ve made this decision.

Here are some frequently-asked questions about leaving CMS a gift in your will (click on the questions to reveal the answers):

What type of gift can I leave to CMS?

There are three main types of gift you can leave in your will:

- A specific gift is a gift of a specified item such as a personal possession, land, buildings or stocks and shares.

- A pecuniary gift is a specific sum of money. It is worth noting that the value of a pecuniary gift will decrease over time due to economic inflation.

- A residuary gift is a percentage of what is left of your estate after pecuniary gifts have been made and expenses and taxes have been paid. You can leave a residuary gift to one beneficiary or divide it between several beneficiaries.

How do charitable gifts affect the amount of inheritance tax my estate will pay?

A gift to CMS in your will is tax free, and may also reduce the amount of inheritance tax the rest of your estate will pay. A gift of at least 10 per cent of your taxable estate to charity will reduce the inheritance tax rate for the remaining amount of your estate over the inheritance tax threshold (currently £325,000) from 40 to 36 per cent.

Can I leave money in my will to a certain person or area of mission?

You can, but we advise against this as our people in mission and areas of work sometimes change. Depending on the wording in your will and changing circumstances, we may not be able to use a gift from you for legal reasons. If you feel passionately about this, please call us and we can talk you through some wording which would still allow us to use the money to further God’s Kingdom if circumstances change.

What wording should I use to include a gift to Church Mission Society in my will?

We strongly recommend you have your will drafted by a solicitor to ensure your wishes are correctly carried out. If you have chosen to remember us in your will, here are some wording examples that you may find helpful to take to your solicitor when discussing your will:

In the case of a residuary gift (a proportion of the remains of your estate): “I give ___% of the residue of my estate to Church Mission Society…”

In the case of a pecuniary gift (a specific amount of money): “I give the sum of £___ to Church Mission Society…”

CMS must be very precisely identified in your will; its name alone may not suffice. Subject to legal advice, you should always follow the name of CMS with its registered charity number and address, and with details as to how the gift can be received. Your solicitor may suggest something along the following lines: “Church Mission Society (Registered Charity Number 1131655) of Watlington Road, Oxford OX4 6BZ, for its general purposes absolutely. I direct that the receipt of the treasurer or other proper officer of the charity shall be a full and sufficient discharge for this legacy.”

I want to leave a gift to Church Mission Society. What are the charity’s details?

Church Mission Society

Watlington Road

Oxford

OX4 6BZ

A charity registered in England and Wales (1131655) Scotland (SC047163)